Turnkey Rental Investment vs. The Traditional Retirement Plan: 401(k)

This article is the first installment in a series on retirement plans. In each post, I compare paper asset options against turnkey real estate investments. My goal is to show you why you may be better off calling your turnkey provider than your stock broker.

Because of the relatively low cost and low risk to employers, the 401(k) has become the primary retirement benefit companies offer employees. According to the U.S. Department of Labor, there were over half a million of these plans available in the U.S. in 2014.

How does a 401(k) Plan work?

The 401(k) is an employer-sponsored investment plan that allows the employee to contribute to his or her retirement on a pre-tax basis. The money is then invested in funds you select from a list managed by your plan provider.

As opposed to a pension, where your benefits are guaranteed, the 401(k) is a defined contribution plan. Therefore, the risk of what happens to the money over time falls on the employee rather than the employer.

What are the advantages of a 401(k)?

In most cases, your employer will match 401(k) contributions up to a certain percentage of your salary. This amounts to free money for your retirement. Additionally, the automatic nature of each contribution ensures you'll stay faithful to your long-term savings goals. In fact, you probably won't even notice the regular withdrawal.

As noted above, your contributions are tax-deferred. This lowers your tax bill today. In exchange, you pay taxes when you withdraw the money in retirement with the idea being that you will be in a lower tax bracket at that point in time.

What are the disadvantages of a 401(k)?

A 401(k) is not a savings account. Any funds withdrawn before you turn 59.5 will result in a stiff 10% penalty from the government. Additionally, all 401(k) withdrawals are taxed at your ordinary income tax rate�regardless of when you withdraw them.

The biggest disadvantage though is that the average long-term return for a 401(k) is 5%. Over the next 10 years, even this may be difficult to achieve according to a Bloomberg article based on data from Research Associates.

How can turnkey rental property be a better long-term investment?

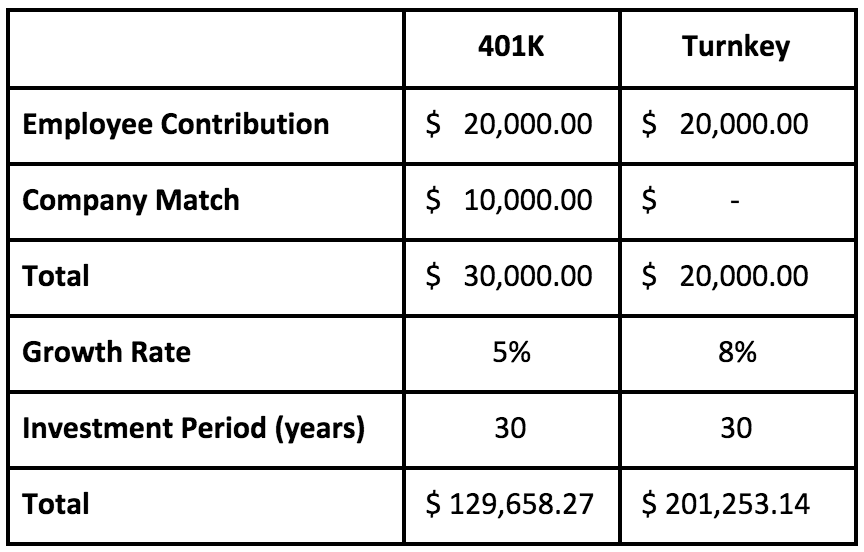

The biggest advantage of turnkey real estate investing is the returns are much higher. Even after properly accounting for all of the expenses, turn key properties can yield 8-15%+ over the long-term. A quick analysis shows that this easily produces more money for your retirement even if you don't get the company match.

Another key factor to consider is cash flow. With rental property, you increase both your income and net worth. The income portion comes in monthly and isn't subject to valuation changes caused by market crashes.

Similarly, turnkey rental property offers easier access to your capital. Without necessarily selling a property, you can use a line of credit to draw on the home's equity in emergency situations. Although you may pay a nominal interest rate, it'd be nothing like the 10% penalty charged for early 401(k) withdrawals.

My Verdict

The 401(k) is a great product to teach people to start investing and is certainly better than not doing anything especially when you are first starting out. However, educated investors want to earn higher returns and expose themselves to less risk. Turnkey investment properties are more likely to achieve these goals over time.